Ready to help treat your pet to a healthy life?

Understanding Pet Insurance: A Clear Guide to Terms, Coverage, and What Really Matters

By : Brooklyn Benjestorf | Published Sep 16, 2025

With all the jargon, fine print, and confusing coverage options, choosing the right pet insurance plan can feel overwhelming. Yet more pet parents than ever are searching for the best pet insurance to protect their dogs and cats. So how do you cut through the clutter and figure out what really matters?

This guide clarifies coverage, defines key terms, and breaks down what to look for when comparing providers. Whether you’re brand new to pet insurance or rethinking your current plan, you’ll come away with a clearer understanding of how to choose the best protection for your furry friend.

What is pet insurance and why does it matter?

Pet insurance is designed to protect your pocketbook when your dog or cat faces unexpected health issues. From accidents and injuries to long-term conditions, it helps cover the cost of medical care so pet parents can focus on what’s important: being there for their pet.

Pet insurance allows you to budget for the unexpected, so you’re not put in a situation where you must make an impossible choice where you’re weighing the contents of your bank account against saying yes to the care your pet needs. Pet insurance makes that care an easy yes, every time.

Vet bills for even smaller accidents and injuries can run around a grand or more, and with chronic conditions, the bills can stack up very quickly. That’s not even considering more extreme medical issues that may require advanced treatments like surgery, hospitalization, or cancer therapy which often cost several thousand dollars or more.

The true cost of veterinary care*

Broken or torn nail — $541

Bite injury — $1,468

Poisoning — $1,668

Vomiting — 1,798

Foreign Body Ingestion — $4,032

Fracture — $4,339

Intervertebral Disc Disorder (IVDD) — $5,170

Lymphoma — $5,310

Spinal Myelopathy — $5,327

Pneumonia — $5,688

Allergies (lifetime) — $3,328+

Diabetes (lifetime) — $11,060+

* Based on averages of Trupanion USA internal invoice data from Jan. 1, 2025 – Aug. 31, 2025.

+ Based on a specific data set of Trupanion Core Brand policies in the USA with pets enrolled for at least 10 years. All average total claimed figures were adjusted for a 5% compound annual growth rate (CAGR) inflation.

That’s where pet insurance makes all the difference. By paying that predictable amount each month in the form of the premium, you gain peace of mind knowing you can put your pet’s well-being above what’s in your pocketbook. It’s about having a financial safety net when you need it most.

Key pet insurance terms explained

When searching for the best pet insurance plan, it’s important to understand the key terms and conditions of each policy, but you can’t do that without understanding the language first. Below we dive into some common pet insurance terminology to help pet parents better understand either their current policy or the policies they may be considering. Here’s a breakdown of the most important terms to know:

- Premium

- The monthly cost you pay to keep your pet insured.

- This keeps your coverage and protection active.

- Deductible

- The amount you pay out-of-pocket before your insurance kicks in.

- Example: If your deductible is $250 and your vet bill is $1,000, you pay $250 and your insurance helps with the rest of the eligible costs.

- Co-Insurance

- The percentage of your bill the insurer will cover after the deductible.

- Some plans reimburse 70%, 80%, or 90%. Trupanion can pay the veterinarian directly at checkout.

- Payout limits

- The maximum amount your insurance will pay, either per year or over your pet’s lifetime.

- Some plans may cap payouts at $5,000 a year, while others may cap them out at $10,000 over the pet’s entire lifetime, and then there are plans that have no caps at all.

- Coverage without limits means no caps — which can be critical if your pet faces a serious illness or injury.

- Exclusions

- Conditions or treatments the insurance won’t cover.

- For example, most providers will exclude pre-existing conditions.

- Waiting period

- The time between enrolling and when your coverage starts.

- This prevents people from signing up the day their pet gets sick.

Understanding these terms will help you feel more confident as you compare providers and make the best choice for your pet’s health, and your own peace of mind.

How to compare pet insurance plans

Evaluating pet insurance unfortunately isn't as easy as an apples-to-apples comparison. To feel confident you’re choosing the best pet insurance for you and your pet, it’s important to understand the major factors that set providers apart (and sometimes end up buried in the fine print). Here are the most important things to compare:

Coverage types

Some plans only cover accidents, while others cover accidents and illnesses, including hereditary or chronic conditions. Look for a plan that covers everything—from emergencies to ongoing treatments—so you won't be caught off guard later.

- Co-Insurance method

- Most companies reimburse you after you’ve already paid your vet bill, which can take days or even weeks

- Trupanion can instantly pay your veterinarian directly at checkout (where available), which means even less financial fuss to worry about.

- Limits and caps

- Many providers set annual or lifetime payout limits, and once you’ve hit that limit, you’re on your own.

- With no payout limits, you can have peace of mind knowing your pet can receive care without limits.

- Deductibles and monthly cost

- A lower deductible usually means a higher monthly payment, while a higher deductible lowers your premium.

- Choose a balance that fits your budget while still protecting you from major bills.

- Exclusions

- Every plan has exclusions (for example, most don’t cover pre-existing conditions—but read the fine print here! Not all providers define pre-existing conditions the same way).

- Understanding any policy exclusions up-front will help you avoid any surprises at crucial moments when it could end up being costly.

Pro tip: Don’t just look at the monthly cost! A plan may seem cheaper, but if it caps payouts or excludes common conditions, you could end up paying much more in the long run.

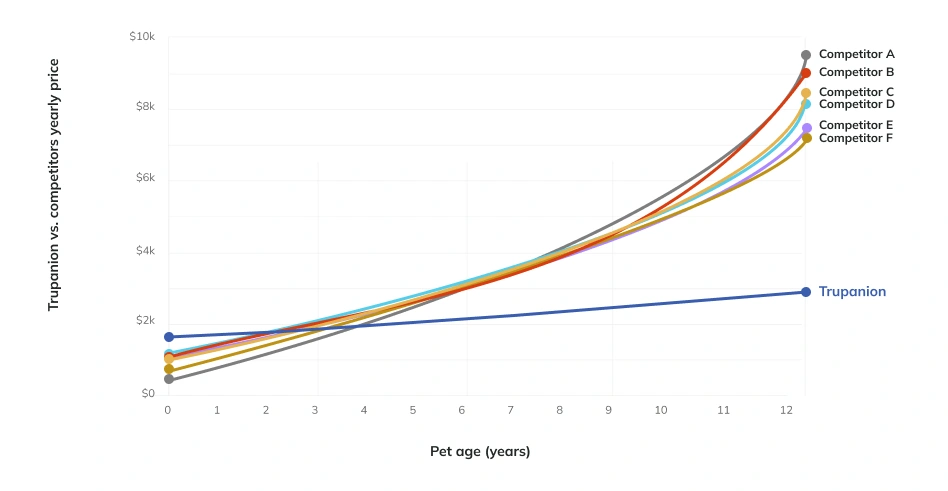

This example is based on a Labrador puppy in California, where we compared Trupanion's lifetime cost with Pets Best, Lemonade, Embrace, Pumpkin, MetLife, and Fetch. Information was pulled from public filings as of March 1, 2025 and includes assumptions based on annual inflation. Results may not apply universally.

What makes the best pet insurance plan?

When looking for the best pet insurance and comparing one plan to another, pet parents often wonder: What features really count in these pet insurance plans? While price does matter, the true value of a plan boils down to how well it’s going to support you when your pet needs it the most. Here are the big ideas to consider when shopping around:

- Comprehensive coverage

- The best pet insurance plans will cover a wide range of medical needs from accidents and injuries to chronic conditions and unexpected illnesses.

- Watch out for policies with narrow coverage or long lists of exclusions.

- No limits on payouts

- Medical care for pets can rack up quickly. Chronic conditions like allergies can add up to hundreds of dollars in medications every year, a single surgery can cost thousands, and life-saving treatment for something like cancer can exceed tens of thousands.

- Plans with no payout limits help prevent having to choose between your pet's health and your finances.

- Transparent, simple terms

- Look for providers that make their policies clear and easy to understand. Complex benefit schedules or extensive fine print can leave you in the dark about what isn’t covered.

- Fair, consistent pricing

- Some providers will raise rates, change terms or even drop coverage entirely when pets have expensive or frequent vet visits.

- The best plans don’t punish pets for being “unlucky.”

- Ease of payment

- Does the provider pay your veterinarian directly, or do you have to pay out-of-pocket and wait for reimbursement?

- Direct payment to your vet means less stress during emergencies and faster care for your pet.

At the end of the day, the best pet insurance plan is the one that gives you the most peace of mind. It’s the one that makes you feel safe, helping you say “yes” to the care your pet needs.

How to choose the right pet insurance for your pet

With so many different options out there, narrowing down the best pet insurance for your furry friend can be daunting. Here are a few things to think about to guide your decision:

- Your pet’s individual needs

- Young, healthy pets may seem “low-risk,” but enrolling them early helps lock in that coverage before any potential health problems may develop.

- Breeds prone to certain conditions benefit the most from comprehensive coverage that includes hereditary and congenital conditions.

- Compare all the coverage details (not just the price)

- Look beyond what you’ll be paying for monthly premiums. Ask what’s included, what’s limited, and what’s excluded.

- Plans with payout caps, benefit schedules, or exclusions might look cheaper upfront but you may end up paying more in the long run if you’re unable to use the policy when you need it most.

- After a recent vet exam, activate an Exam Day Offer (within 24 hours of the exam) and get 30 days of coverage to see if Trupanion is a good fit for your pet and your family.

- Check for direct-to-vet payments

- Most providers reimburse you after the fact, leaving you responsible to cover those large bills upfront. Trupanion can pay your veterinarian directly at the time of checkout, further alleviating financial worries during stressful times.

- Read the fine print!

- This is the only way to be absolutely sure that the policy you’re signing up for doesn’t penalize pets for multiple claims, frequent vet visits, or costly medical needs. There can also be hidden definitions around exclusions, so be sure to keep an eye out for those as well. True peace of mind means knowing your coverage will be there when your pet needs it most.

- If you have questions about Trupanion’s policy, our award-winning contact center is available 24/7/365 to answer your questions and is just a phone call away. We may not be able to help answer questions about other providers, but we’re always happy to dig into the details about Trupanion so that you feel like you know the policy inside and out.

The bottom line

The best pet insurance is the one that helps you say “yes” to care. It should provide coverage without limits, straightforward terms, and reliable financial support, so your focus stays exactly where it belongs: on your pet’s health and happiness.

At Trupanion, we’ve paid out more than $3.4 billion in veterinary invoices on behalf of our members, with $1.9 billion paid directly to the vet. Our mission is simple: to help loving, responsible pet parents budget and care for their pets.

Ready to find the right coverage for your best friend? Explore Trupanion’s plan today and see how we can provide peace of mind for you, and lifelong care for your pet.